Rocket Pool: Decentralised Liquid Staking

This week’s highlight is Rocket Pool, a decentralised liquid ETH staking protocol. Let’s break down what this means and how it works!

ETH staking is the mechanism that secures Ethereum via Proof-of-Stake. Transactions are validated by stakers who have an economic incentive to do so:

- if a validator attests to a valid block, they are rewarded with ETH

- if a validator is malicious, they risk losing their staked ETH

Each validator must stake 32 ETH, which is about $116,000 at current prices.

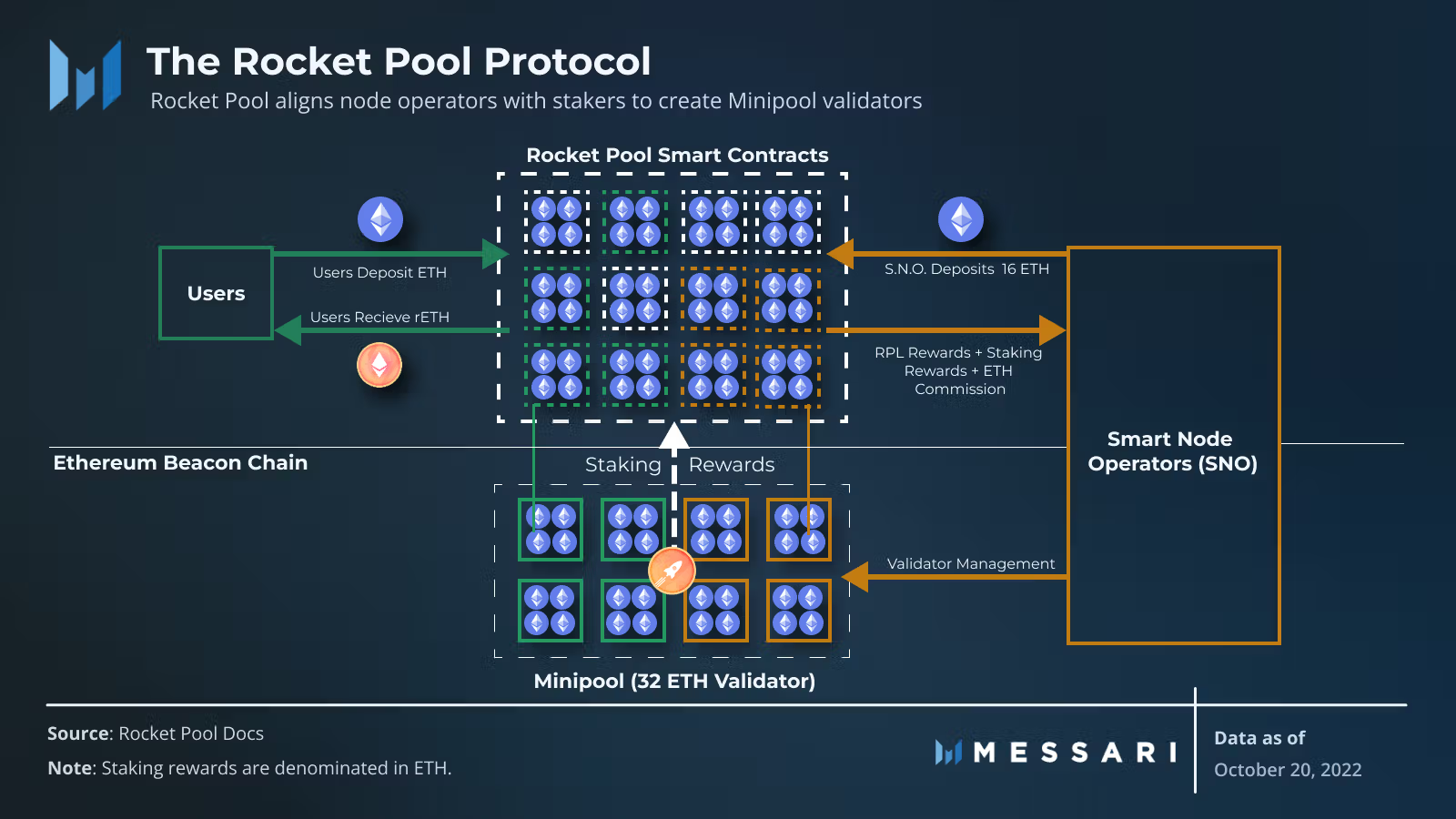

Liquid staking protocols like Rocket Pool allow users to pool their ETH to meet the 32 ETH requirement.

A Liquid Staking Token (LST) is an ERC-20 that represents a claim on the deposited ETH and the staking rewards it generates. For Rocket Pool, this token is rETH. It can be freely used across DeFi, from DEXs to lending, thereby improving capital efficiency compared with non-liquid staked ETH which is locked and can’t be used while staked.

Rocket Pool’s key differentiator from other LSTs is that it allows for permissionless node operators. Anyone can run a node via Rocket Pool by staking a minimum of 8 ETH, four times less than a traditional ETH node. The remaining ETH is contributed by Rocket Pool users that don’t run a node.

To learn more about how Rocket Pool exactly works, this post series is a good place to start.

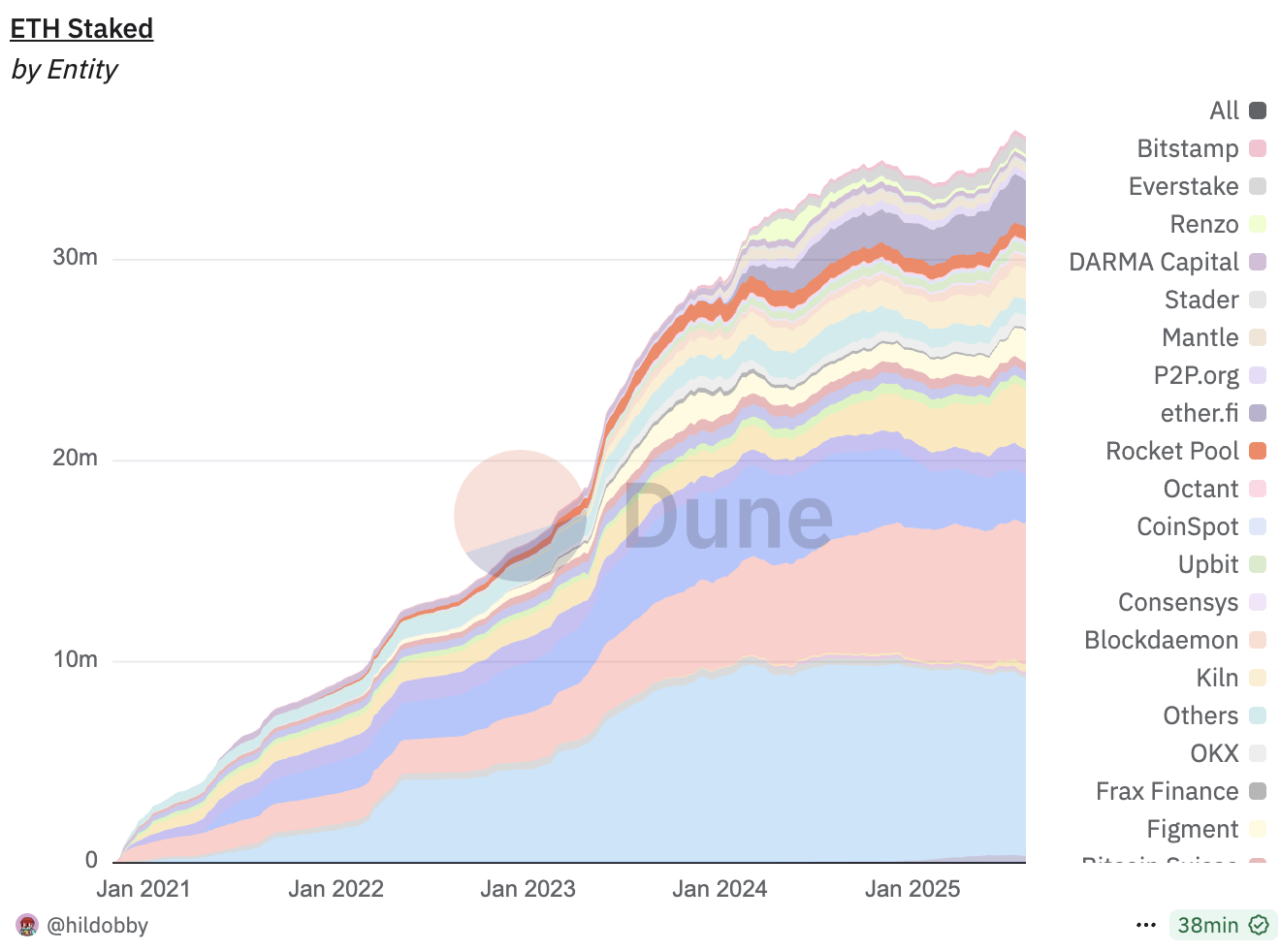

Currently, Rocket Pool accounts for just under 2% of all ETH staked. The largest liquid staking provider is currently Lido with stETH having a 24.5% market share.

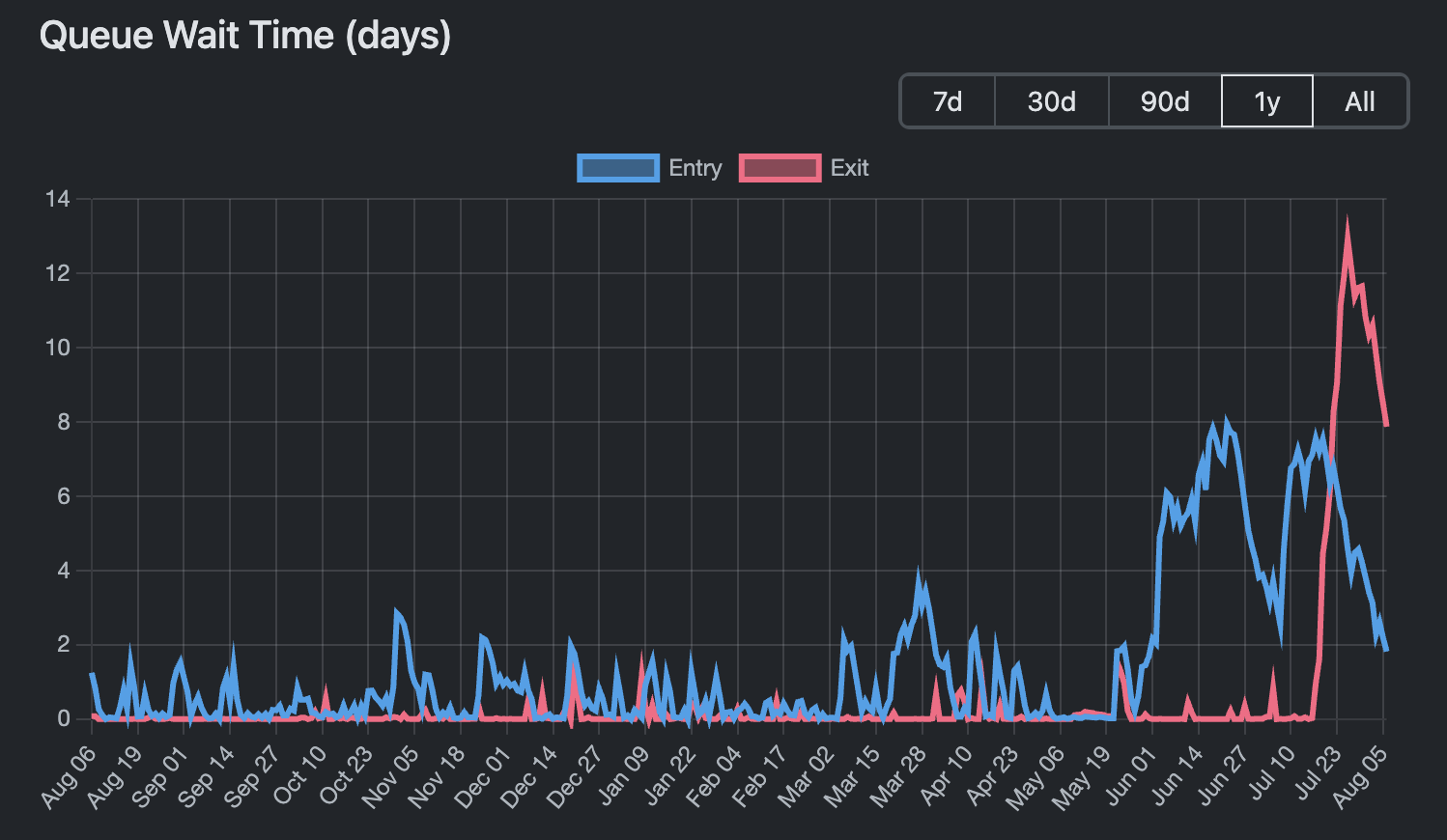

A key risk in ETH staking is the time it takes to unstake. To withdraw staked ETH, a validator must enter an "exit queue". During times of volatility, this queue can become congested, leading to withdrawal delays that could last for days. There is currently a one week wait time to unstake.

While LSTs can often be instantly swapped for ETH on a decentralized exchange, this is not a guaranteed 1:1 redemption. In a market panic, the price of an LST could temporarily de-peg from the price of ETH.

Rocket Pool plays an important role in making access to staking and the operation of Ethereum nodes more accessible. We’re excited to follow along as the community keeps pushing in this direction. You can now claim your share of rETH in Fluidkey.

Note that none of our highlights are financial advice. The value of any of the tokens highlighted may go to zero.

See you next week!