Reserve: Onchain Indexes

What if you could get exposure to every major DeFi protocol in one click? Or buy a basket of every token we’ve highlighted on Fluidkey so far?

This week’s highlight, Reserve Protocol, is making this possible. It enables the onchain version of ETFs: DTFs (Decentralized Token Folios).

You can now claim your share of RSR in the Fluidkey app.

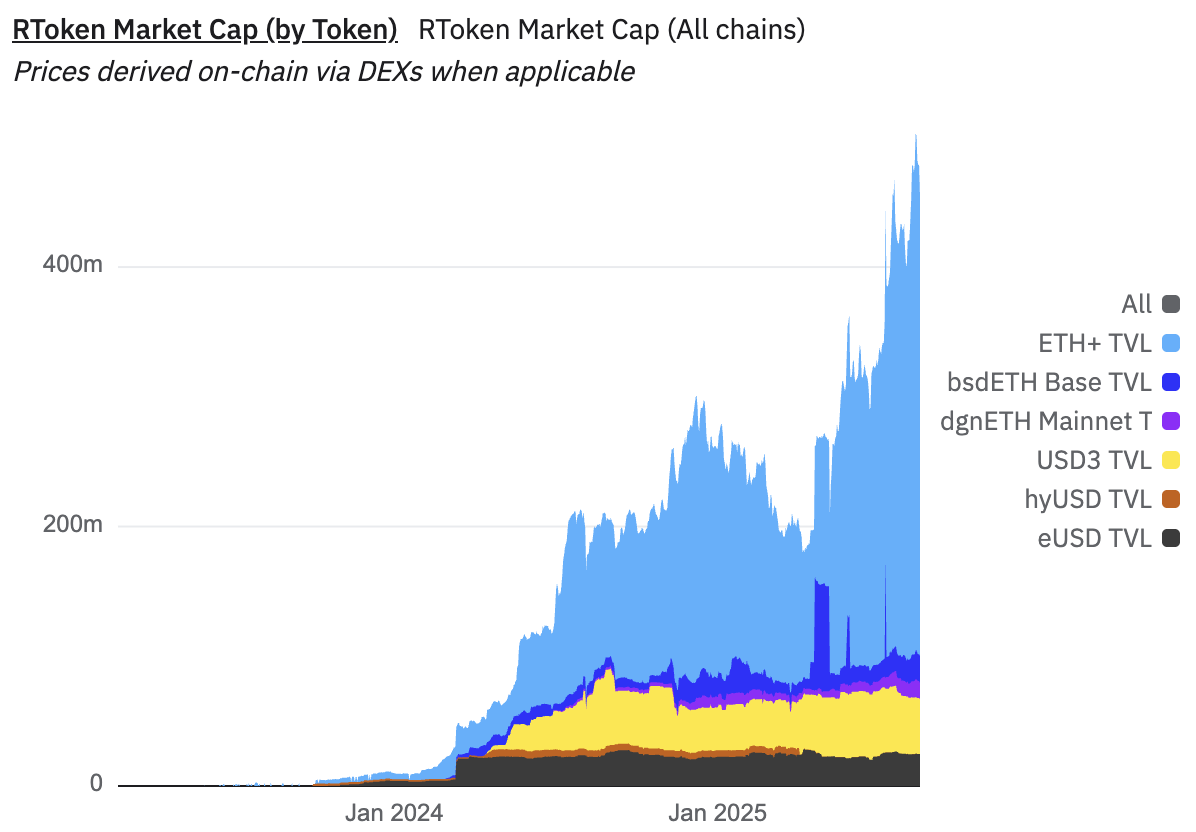

Reserve has grown to just under $500m in TVL, initially focusing on blue-chip yield and stablecoin indexes. For example, the ETH+ DTF gives exposure to a basket of ETH liquid staking tokens like wstETH and rETH.

Now Reserve is expanding its protocol to support indexes that cover a wide range of crypto assets across Ethereum and Base, similar to the way ETFs work for stocks.

Additionally, indexes can provide exposure to assets from other chains via wrapped tokens from Universal.

For instance, the Large Cap DeFi Index gives exposure to a basket of tokens including Aave, Uniswap, Pendle, and Morpho. Buyers of the index token get exposure to all of these assets in one transaction.

While DTFs are currently being rolled out with a small set of partners like Bloomberg and CoinDesk, their creation is ultimately intended to be permissionless.

Each index’ governance happens onchain based on a token that is set at the time of creation.

Reserve enforces a minimum of 0.15% platform fees which accrue to its RSR token via a buy-and-burn mechanism. Many indexes also use RSR as their governance token.

We’re excited to see Reserve make onchain indexes a reality - from blue-chip baskets to sector themes and more niche indexes.

Maybe we’ll one day see a Fluidkey Token Highlights index?

Note that none of our highlights are financial advice. The value of any of the tokens highlighted may go to zero.

See you next week!