Morpho: Pricing Trust

This week we highlight Morpho, an onchain lending protocol offering simple, flexible infrastructure. Morpho powers Fluidkey’s auto-earn feature on Ethereum and Base. You can now claim your share of 1,000 MORPHO in the app.

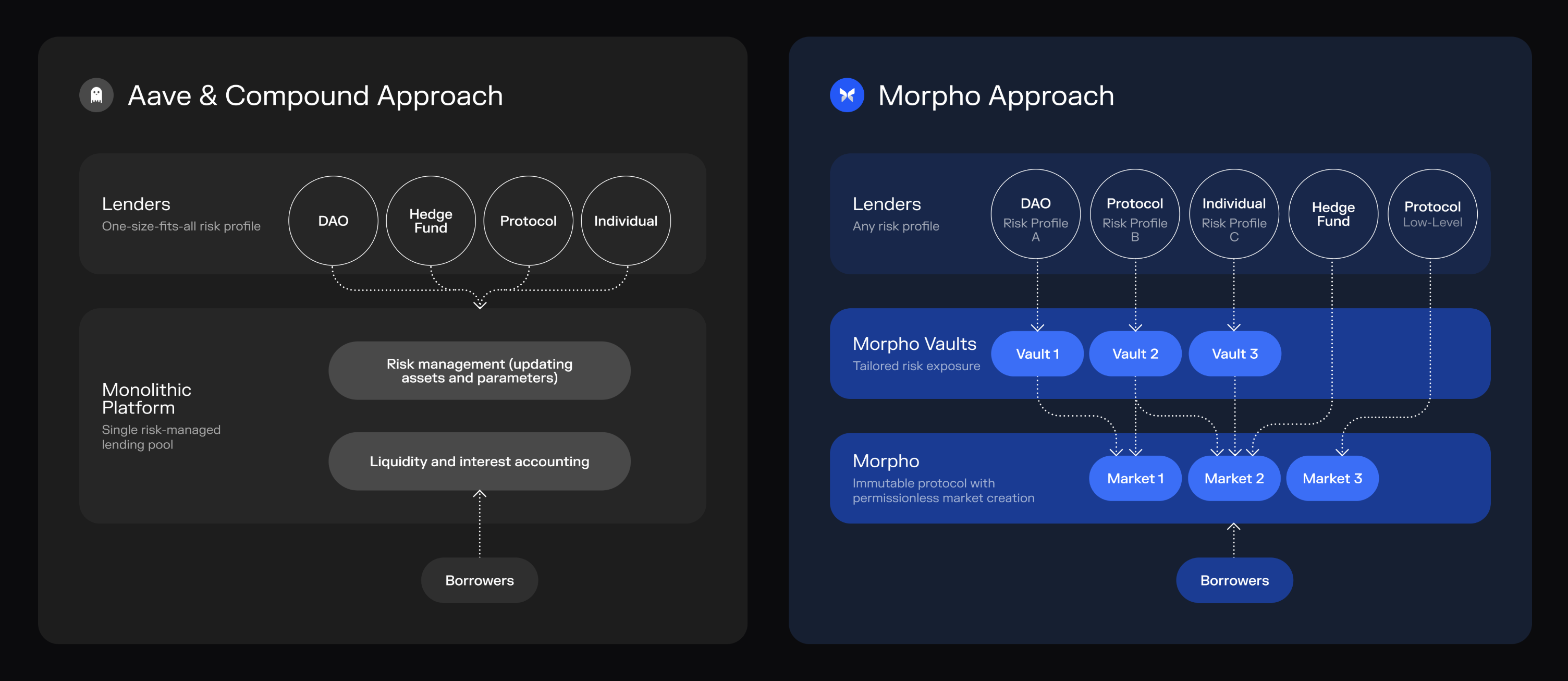

Morpho Vaults stand out from other lending protocols by enabling isolated, curated markets instead of a monolithic design. Concretely, this means that lenders can choose vaults whose risk parameters and curators based on their preferences: pricing trust.

For example, Fluidkey’s auto-earn feature currently integrates Morpho vaults curated by Gauntlet with a low risk profile (Prime & Core). If you have a higher risk tolerance, you could deposit into Gauntlet’s Frontier vaults. And if you don’t trust Gauntlet’s curation, you could deposit into vaults curated by Steakhouse or Re7. Anyone can build on Morpho’s infrastructure, which allows for a competitive vault curation market.

The diagram below from the Understanding Morpho Vaults series helps visualize this:

Both isolated and monolithic approaches to lending markets have pros and cons, this tweet as well as this blog post are good places to dig deeper into their trade-offs.

Morpho’s flexible model suits the DeFi mullet: products can integrate onchain lending infrastructure into their products while retaining a strong degree of control. A prime example is Coinbase’s recent BTC-backed loan product, built on Morpho.

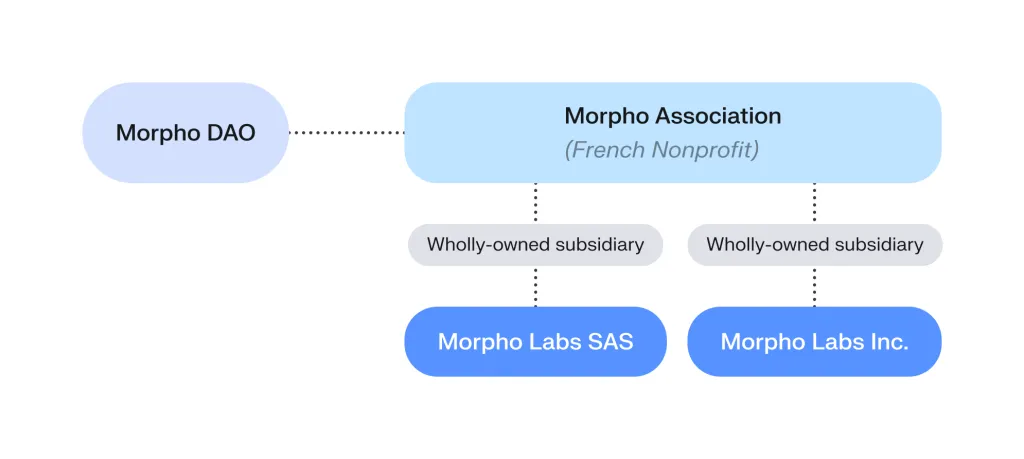

The MORPHO token aligns the team and ecosystem. Founder Paul Frambot recently announced that its Labs entities would now be wholly owned by the Morpho Association, itself governed by the DAO and MORPHO token. This structure prevents misaligned incentives between equity-holding Labs and token holders.

The DAO could enable protocol fees to capture value, but this is unlikely to happen in the short term as the team prioritizes reinvesting in growth. Currently a large number of vaults are incentivized with additional yield in the form of MORPHO rewards.

The team recently announced Morpho v2, extending the protocol to support fixed-rate and fixed-term loans. We’re excited about Morpho’s ambition to enable all types of lenders and borrowers to connect through its infrastructure, a critical piece for a thriving onchain economy.