Maple: Onchain Institutional Lending

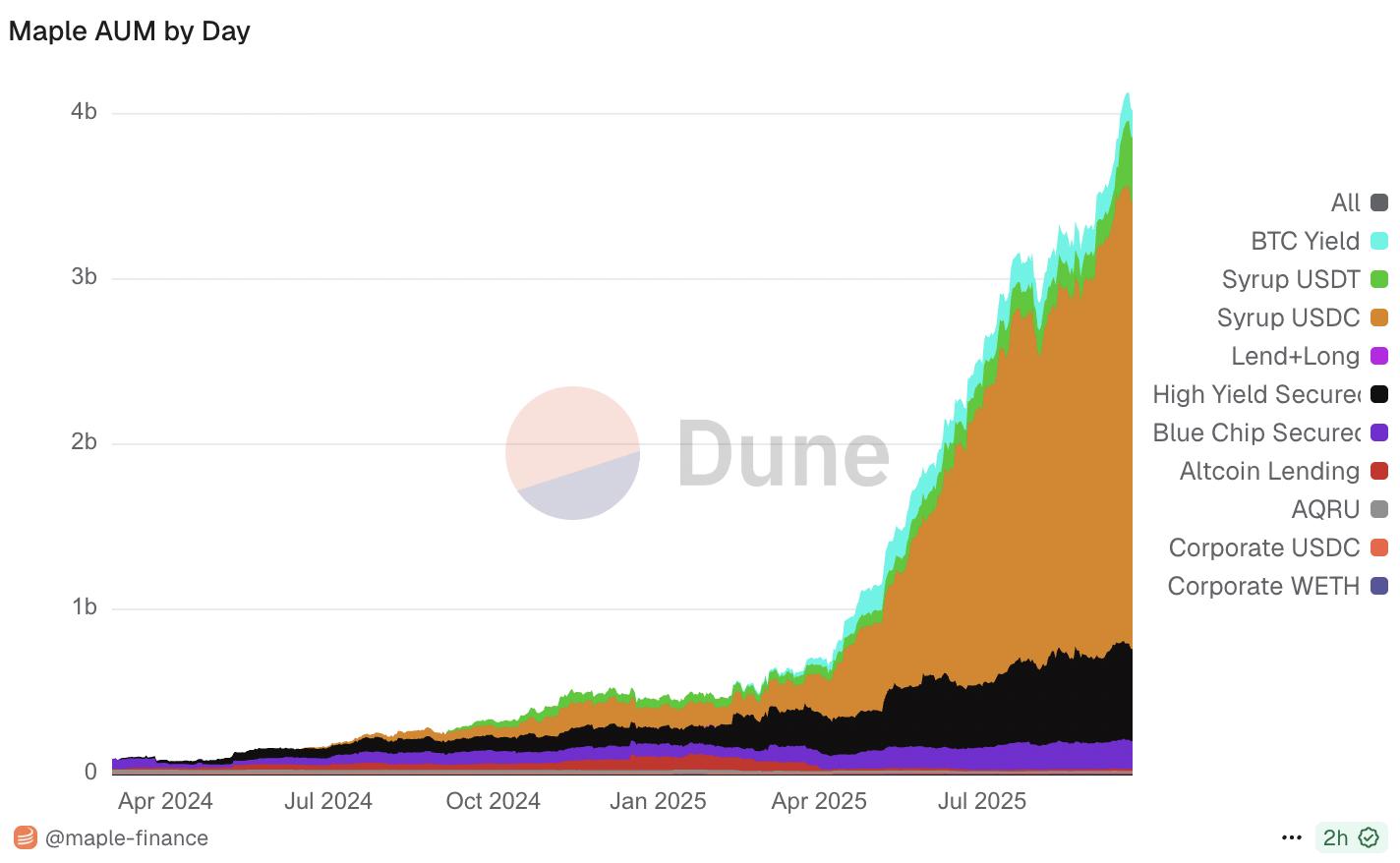

This week we’re highlighting Maple. Maple is bringing institutional lending onchain and seeing explosive growth: AUM grew by 10x this year, reaching $4b. You can now claim some SYRUP on Fluidkey.

Today, typical DeFi lending protocols often don’t meet the needs of large institutions. Institutions want yield and borrowing opportunities that fit with their operations and compliance requirements. Maple is bridging this gap.

In practice, this means:

- Permissioned lending pools to ensure counterparties meet institutional requirements

- Collateral is held by regulated custodians in its unwrapped form (for instance BTC instead of wBTC)

- Offchain legal agreements protecting lenders

So how is Maple still tapping into the power of DeFi?

Its syrupUSDC yield-bearing stable is the key here: it lets onchain users earn yield from borrowing institutions.

By doing so, Maple unlocks:

- Yield from institutions accessible through DeFi protocols like Morpho and Pendle

- Scalable, compliant capital for institutions

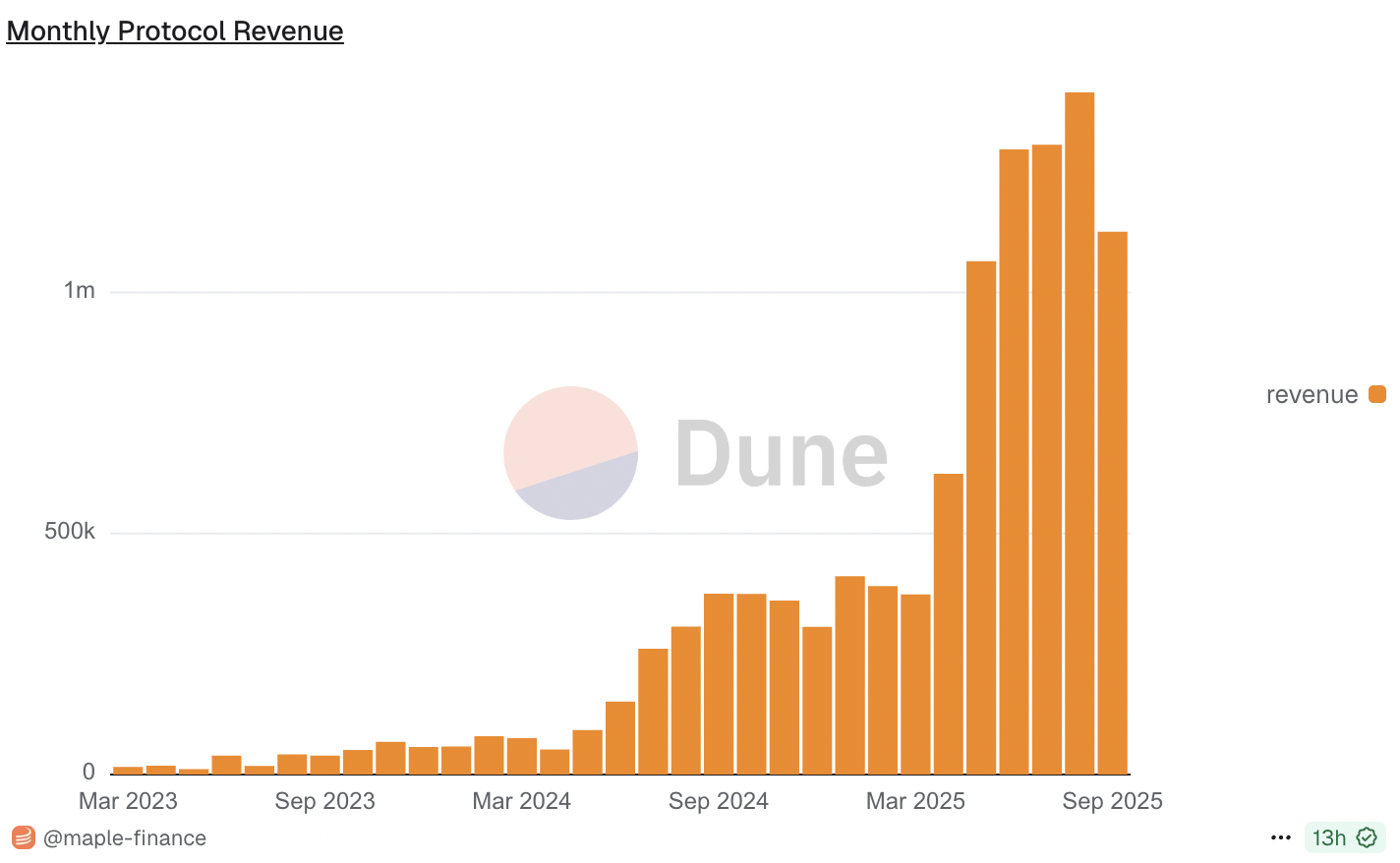

Maple’s SYRUP token ensures the value of the protocol flows back to participants onchain. Staked SYRUP earns rewards from buybacks equalling 25% of protocol revenue, while the remainder of the funds is used to fund Maple’s operations and growth.

To learn more about Maple, The Edge Podcast’s episode with Maple co-founder Sid Powell is a great place to start.

We’re excited to see Maple bring institutional capital to onchain markets while driving value back to its token.

Note that none of our highlights are financial advice. The value of any of the tokens highlighted may go to zero.

See you next week!