Liquity: Decentralized Stables

How do you build a stablecoin that isn’t controlled by one entity? This week we’re highlighting Liquity, a decentralized stablecoin and lending protocol backed by ETH.

Most stablecoins today are managed by a centralized entity that issues the stablecoin against dollars it holds, think USDC or USDT. In contrast, Liquity’s design is permissionless, immutable, and backed only by crypto assets.

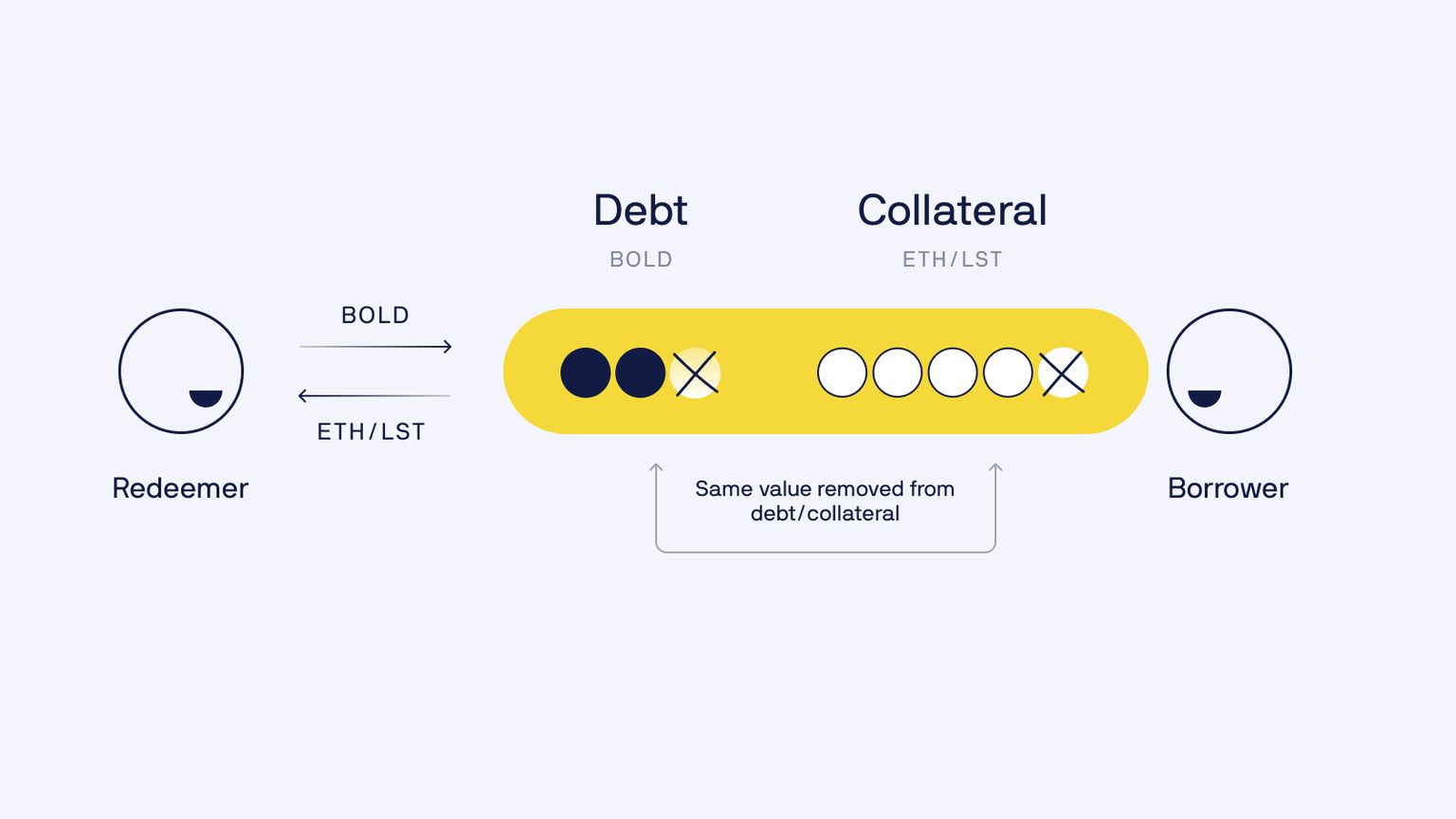

Liquity’s stablecoin, BOLD, maintains its peg to $1 by locking up users’ ETH and liquid staking tokens. Anyone can redeem BOLD for $1 of ETH from the protocol. If BOLD trades below $1, traders can simply buy cheap BOLD, redeem it for $1 of ETH, and push the price back up.

So whose ETH is being redeemed in this scenario? Liquity is also a lending protocol: it lets users borrow BOLD against their ETH. Redemptions come from the collateral of the lowest-rate borrowers.

To dive deeper into the protocol, we recommend this MixBytes post.

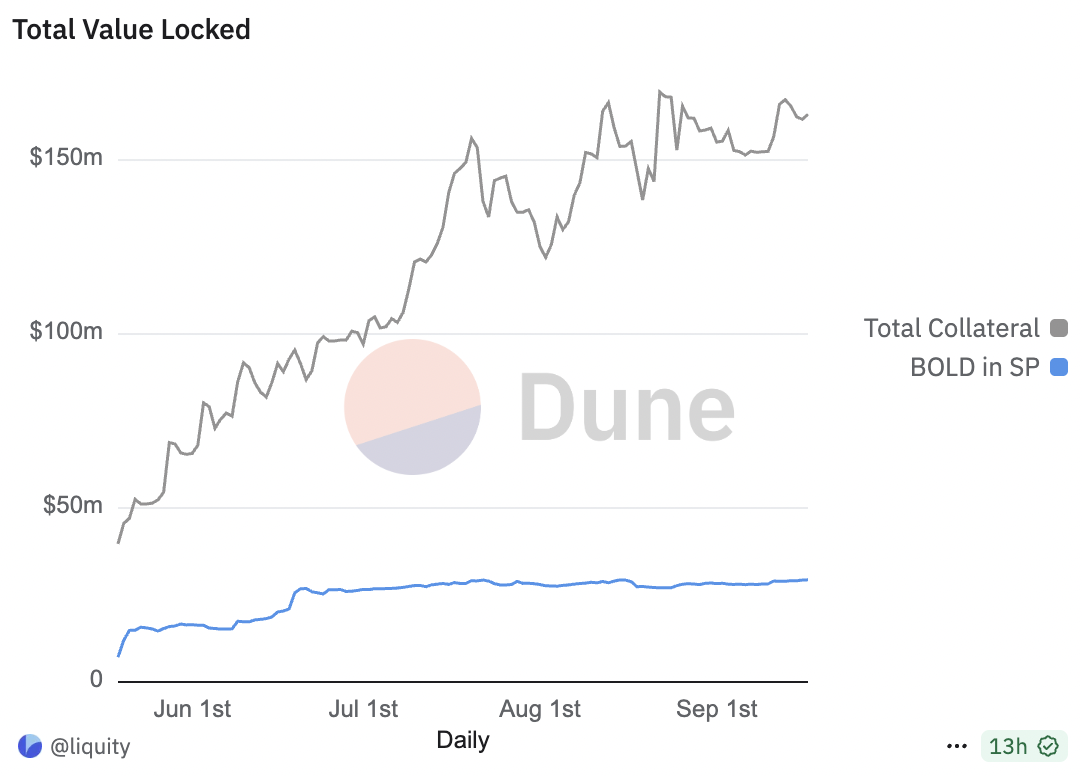

Liquity v2 launched in May and has over $190m in TVL today. There are also multiple friendly forks that have emerged on other chains, such as Nerite on Arbitrum and Felix on Hyperliquid, totalling over $300m in additional TVL.

We’re excited to see Liquity lead the charge on crypto-native stablecoins. You can now claim some USND (the equivalent of BOLD from friendly fork Nerite on Arbitrum) on Fluidkey.

Note that none of our highlights are financial advice. The value of any of the tokens highlighted may go to zero.

See you next week!