CoW Swap: Optimized Trades

Moo! This week’s highlight on Fluidkey is CoW Swap, a trading protocol that ensures users get the most out of their swaps. You can now claim some COW on Fluidkey.

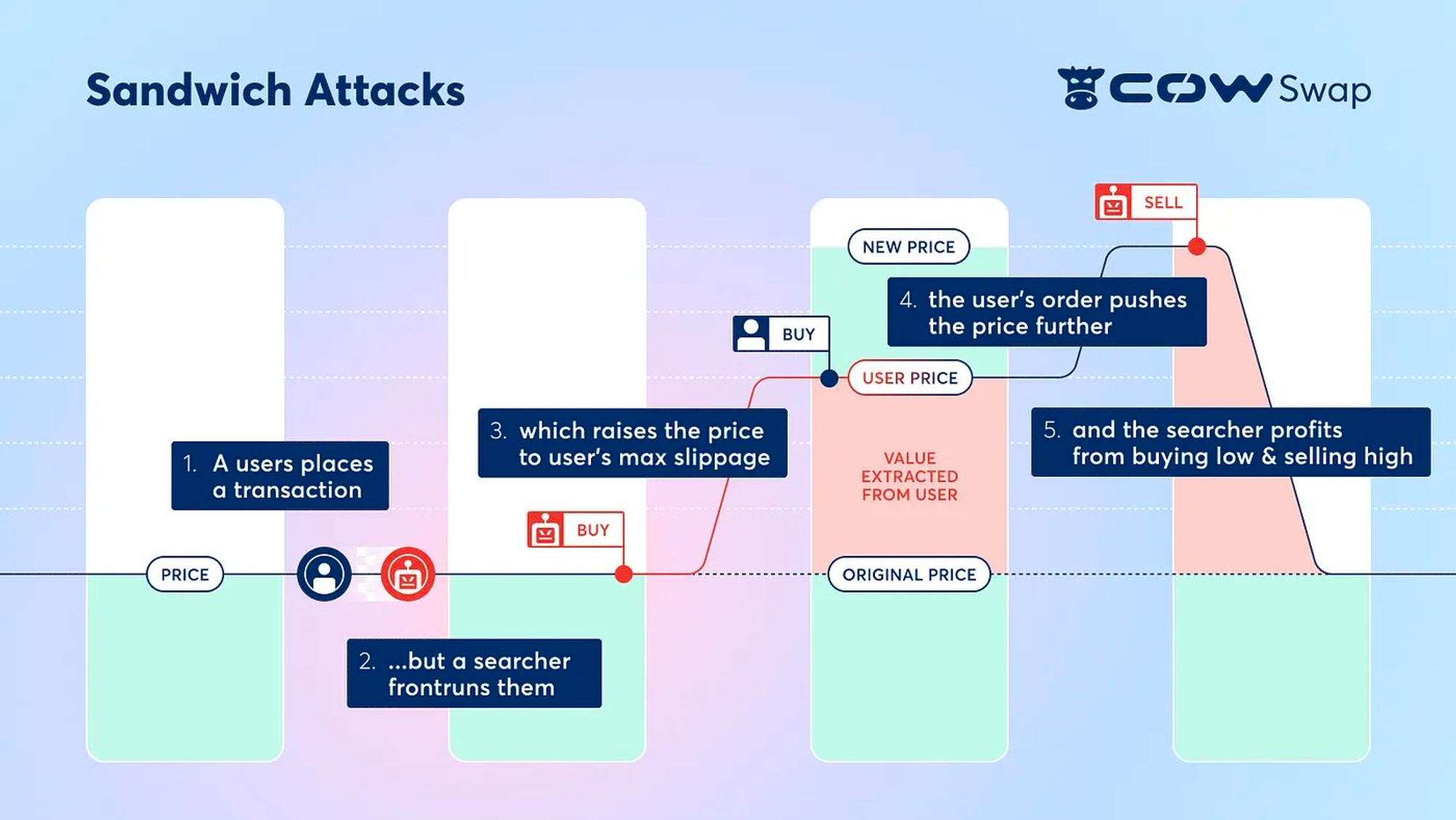

With a typical decentralized exchange like Uniswap users trade in an AMM pool. Each transaction goes to the public mempool and executes on its own at the pool’s price. This can lead to transaction sandwich attacks (MEV).

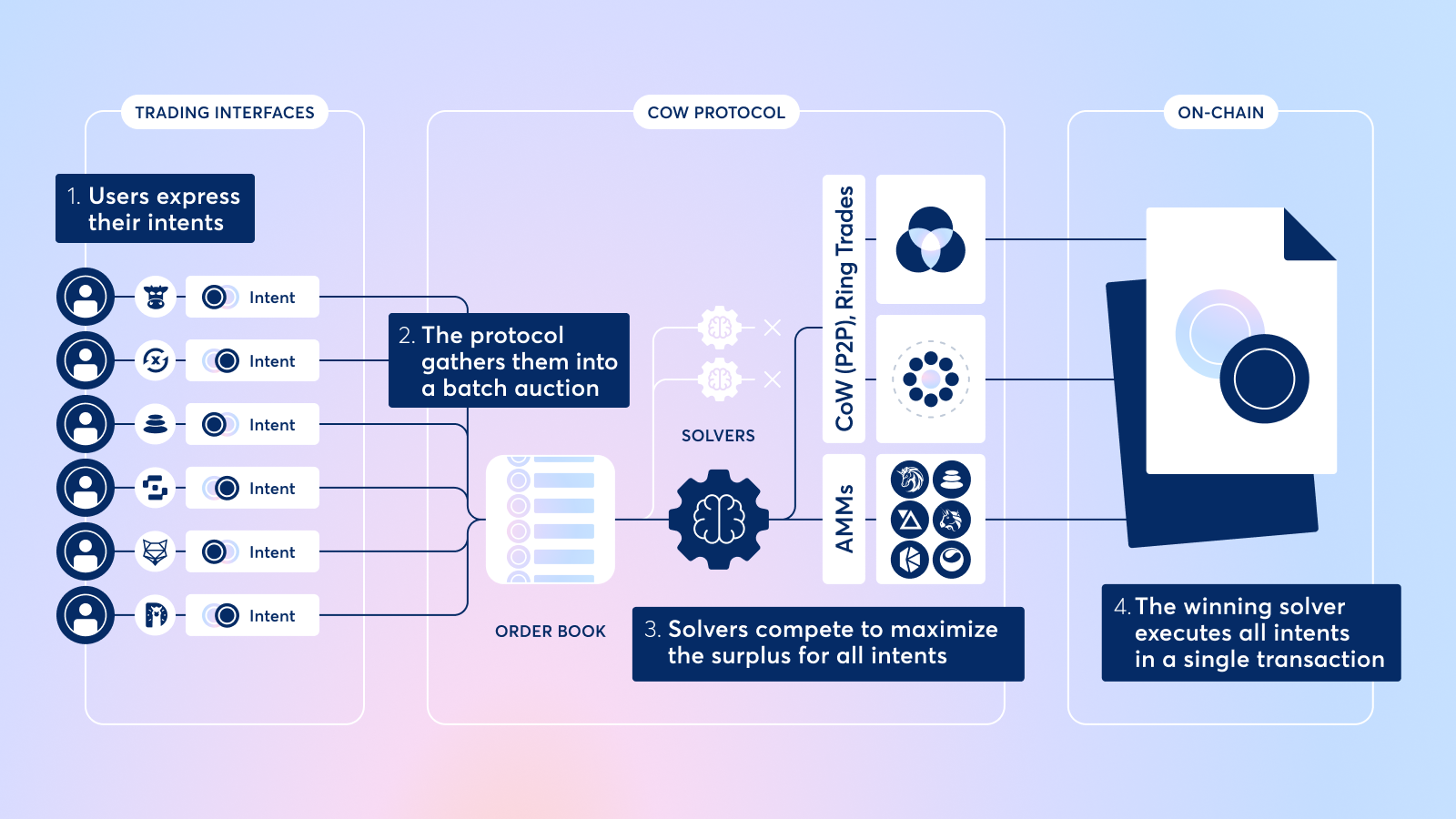

With CoW Swap, transactions are batched and solvers compete to execute the batch at the best price for end users. This prevents sandwich attacks and also makes the transaction gasless for end-users.

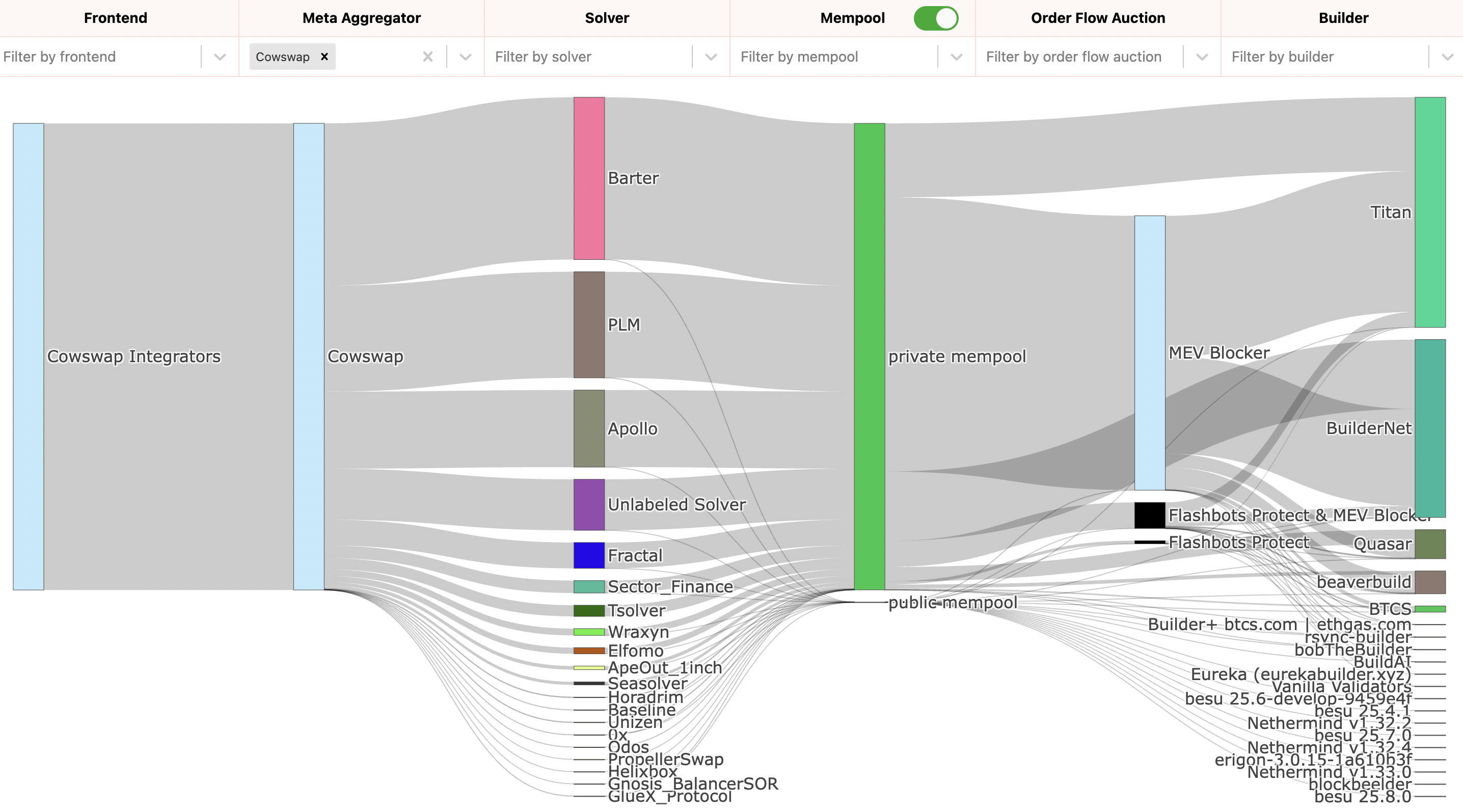

orderflow.art by Flashbots is a great resource to visualize the parties involved in a CoW Swap transaction, including the multiple competing solvers.

Next to standard swaps, CoW Swap is well suited for limit and TWAP (time-weighted average price) orders as transaction intents can be placed offchain and executed at the best price when they are triggered.

To learn more about the tech behind the protocol, this MixBytes piece is a great place to start.

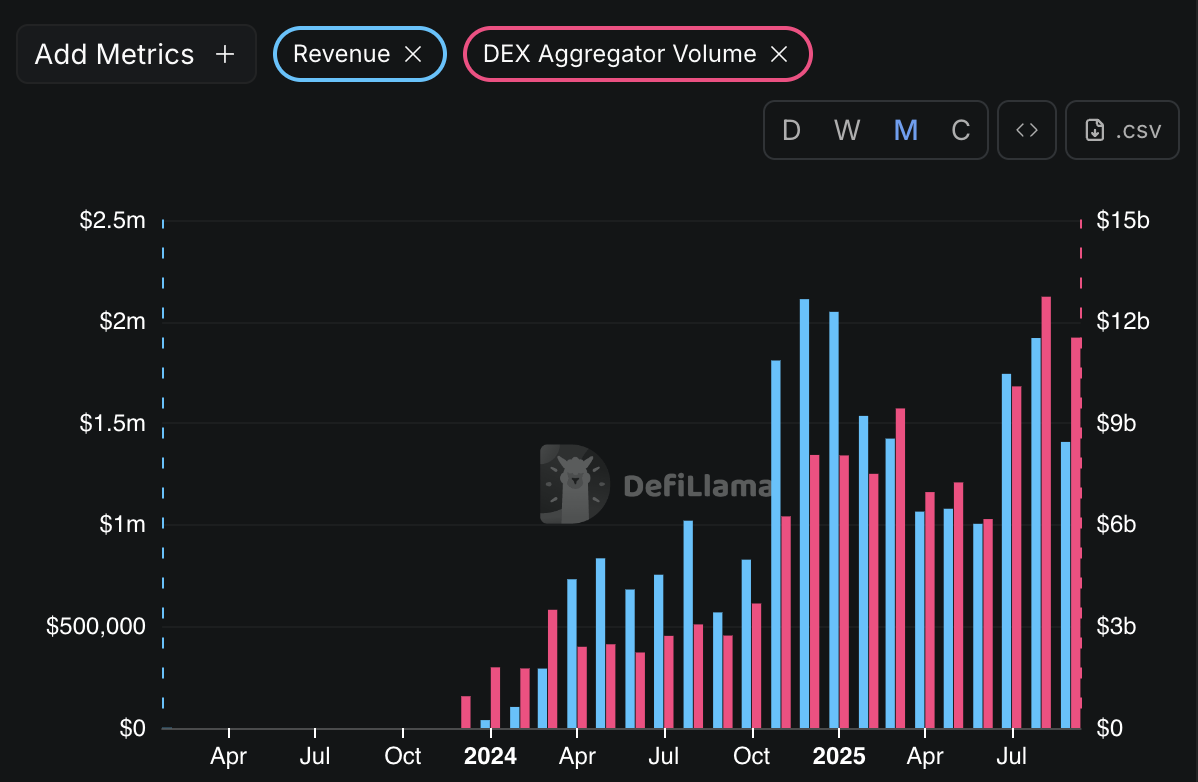

Today, the protocol processes about $12b transaction volume per month and earns about $1.5m in monthly revenues.

CoW Swap is making onchain trading safer and more powerful and we’re excited to keep watching as they innovate!

Note that none of our highlights are financial advice. The value of any of the tokens highlighted may go to zero.

See you next week!