Backed: Tokenized Stocks

What if stocks were tradeable 24/7 onchain and could access the full power of DeFi? This week’s highlight, backed.fi, are making this a reality with tokenized stocks.

Stock markets close overnight and on weekends - with tokenized stocks, assets can be traded all year round. Tokenization also unlocks DeFi composability: think borrowing USDC against your stocks or earning yield on your stocks by lending them.

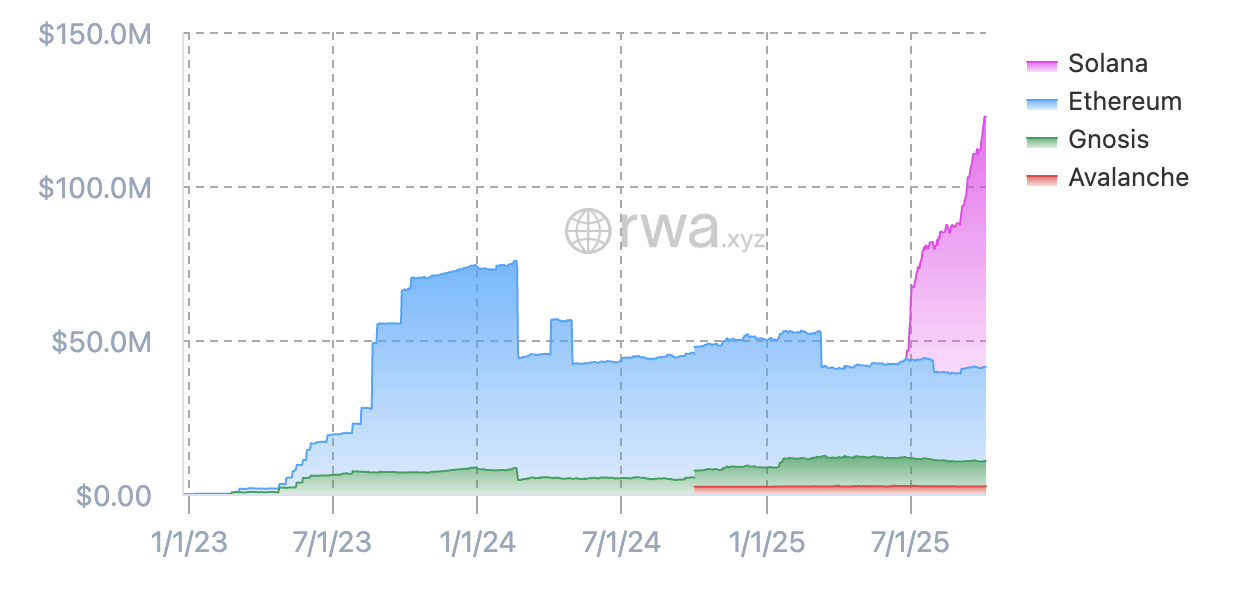

Backed has recently seen strong growth with its xStocks product on Solana, letting users access over 50 different tokenized stocks. These stocks can then be used across DeFi, like lending markets on Kamino. Across EVM chains, liquidity is still relatively low.

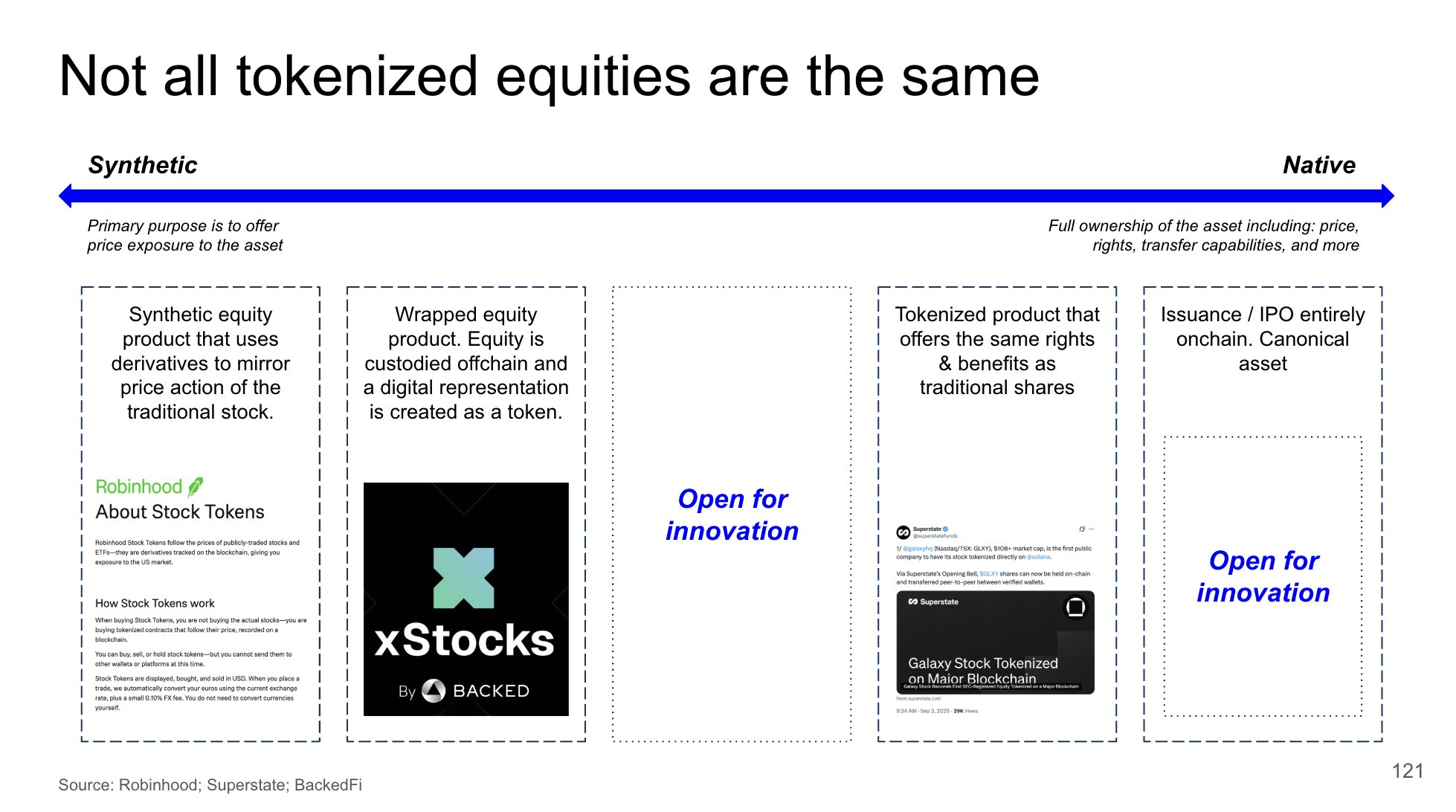

There’s a wide spectrum of approaches to stock tokenization. This post is an excellent starting point to learn more.

Backed’s approach to tokenization is to create a wrapper that is the digital representation of a stock held with a custodian. This means that each token is collateralized 1:1 by shares but doesn’t give holders the exact same rights as shareholders. For instance bCSPX is collateralized by shares of the iShares Core S&P 500 ETF.

Only KYC’d investors can mint and redeem tokenized stocks on the Backed platform. These tokens can then be used freely across DeFi platforms like DEXs, enabling access to a large user base and use cases.

We’re excited to see real world assets come onchain thanks to the work of teams like Backed.

Note that none of our highlights are financial advice. The value of any of the tokens highlighted may go to zero.

See you next week!